Blockchain is a big topic. Many people hear about it but wonder, “how to get started with blockchain?” This guide gives clear steps to understand and use this exciting technology.

What is Blockchain? A Simple Explanation

First thing you need to know on how to get started with blockchain is to understand, what is “blockchain”.

This section breaks down blockchain into easy-to-understand parts. It explains what blockchain is and how its core features make it special.

The Digital Ledger Concept

Imagine a shared digital record book. Everyone on a network has a copy of this book. This book records every transaction or piece of data. Once a record goes into this book, no one can change it.

This system is a “distributed database that maintains a continuously growing list of ordered records, called blocks”. It functions as a decentralized digital ledger that securely stores records across many computers.

This digital ledger differs from a typical database in how it stores and accesses information. Multiple copies of the ledger save on many machines. All these copies must match for any record to be valid.

This distributed nature inherently creates redundancy and ensures data fidelity. If someone tries to alter a record on one computer, the other computers on the network prevent it.

They do this by comparing block hashes, which ensures no single computer can unilaterally change information within the chain. This collective verification makes the data resistant to tampering.

Blocks, Chains, and Cryptography

Blockchain gets its name from how it stores data. It puts transaction data into “blocks”. These blocks link together using a special digital code called “cryptography”. Each block holds a unique “digital fingerprint” or “hash” of the block before it. This linking makes the chain secure.

New blocks always add linearly and chronologically to the end of the blockchain. Once a block is added, previous blocks cannot be altered. If someone changes data in a block, its hash also changes.

Because each block contains the previous block’s hash, a change in one block would change the hashes of all following blocks. The network generally rejects such an altered block because the hashes no longer match.

This chronological and linear addition, combined with cryptographic linking, makes blockchain tamper-proof and highly secure against retroactive changes.

Decentralization and Immutability

Blockchain works without a central boss. No single company or government controls it. Instead, many computers across the world share and update the ledger. This makes it “decentralized“.

All users collectively retain control. This removes the need for trusted third parties, such as auditors, which cuts costs and reduces the potential for human errors.

Once data goes onto the blockchain, it stays there forever. You cannot change or delete it. This is “immutability”. For example, Bitcoin transactions record permanently and are viewable to anyone.

The decentralized nature directly leads to increased transparency. All transactions are transparent and viewable by anyone because each computer in the network has its own copy of the chain.

This ensures that no single entity can unilaterally change information, fostering trust and efficiency.

Why Blockchain Matters: Real-World Uses

Next steps on how to get started with blockchain, you need to know why blockchain matters.

Blockchain is more than just digital money. It changes many industries. Here are some key examples.

Cryptocurrencies and Payments

Blockchain first became famous for cryptocurrencies like Bitcoin. It forms the foundation for these digital currencies. Blockchain allows people to send money directly to each other, fast and often with lower fees.

This happens without banks or other middlemen. Transactions processed over a blockchain could settle in seconds and reduce or eliminate banking transfer fees.

This decentralized nature in payment processing leads to faster, cheaper, and more secure transactions by removing intermediaries.

Supply Chain Tracking

Businesses use blockchain to track products. They can see where items come from and where they go. This helps them find issues quickly and check if products are real.

For example, IBM created its Food Trust blockchain to trace food products from their origin through each stop to delivery. This helps identify the source of outbreaks like E. coli or salmonella quickly, potentially saving lives.

Increased transparency in supply chains, enabled by blockchain, can lead to improved quality control, faster issue resolution, and greater consumer trust.

Digital Identity and Data Sharing

Blockchain can give people more control over their digital identities. Companies like Microsoft explore using it so individuals decide who sees their personal data.

It also helps businesses share data securely between different industries. Blockchain creates opportunities for more secure, efficient, private, and useful record-keeping for areas like healthcare and government work.

Data is easily accessible within the blockchain network, reducing the need for paper documents. Blockchain’s security and decentralization can empower individuals with greater control over their personal data, which reduces privacy risks associated with centralized data storage.

How Blockchain Works: The Core Process

Understanding how blockchain processes information helps one see its power.

Transactions and Blocks

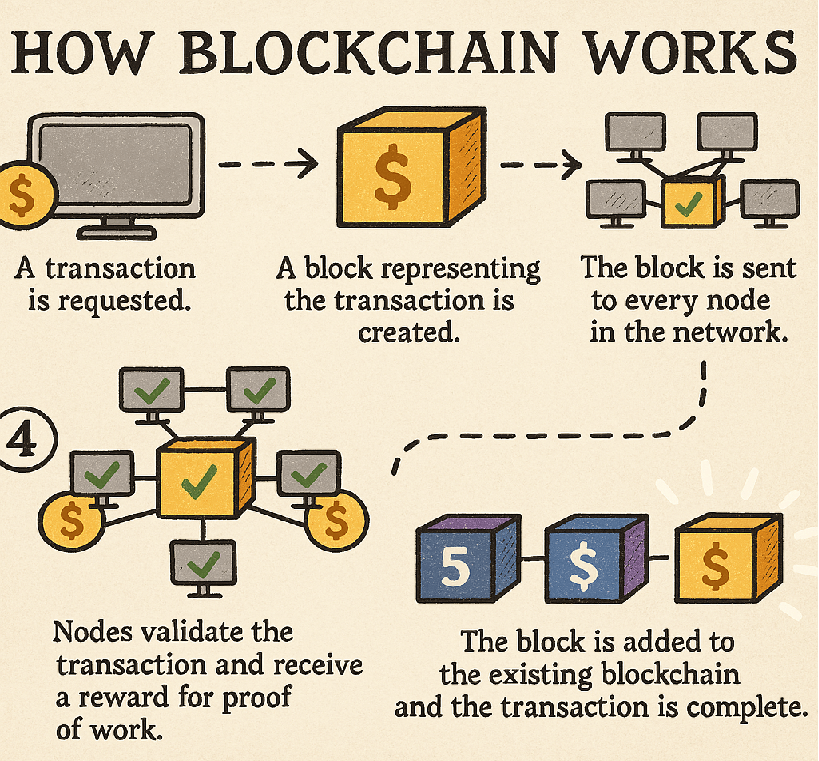

When you make a transaction on a blockchain, here is what happens:

- A user initiates a transaction.

- Blockchain technology records this data into a “block.” This block also holds details like the time, amount, and addresses involved.

- Every computer on the blockchain network gets a copy of this new block.

- All computers work to check and confirm the block. They solve hard computer problems to do this (especially in Proof of Work systems).

- Once confirmed, the block adds to the chain, and the update transmits to all network users.

- If someone tries to change an old block, its digital fingerprint will not match the hashes in later blocks. The network sees this and rejects the change, which keeps the ledger accurate.

This distributed verification process, where all nodes in the network work to verify the block, reinforces blockchain’s security and resistance to fraud.

If attempts to alter earlier blocks result in a hash mismatch, all parties can confirm the ledger’s accuracy, thus preventing malicious changes.

Consensus Mechanisms (Proof of Work vs. Proof of Stake)

Blockchain networks need a way for all computers to agree on new transactions. This agreement process is called a “consensus mechanism”.

These mechanisms ensure all parties agree to the network-verified transaction. Two main types exist:

- Proof of Work (PoW): In PoW, computers called “miners” solve complex cryptographic puzzles. The first miner to solve the puzzle gets to add the next block of transactions to the chain.

They earn rewards for this work. This process requires significant computational power and energy. Bitcoin uses Proof of Work. PoW prevents malicious attempts; a “51% attack,” where an attacker controls more than 50% of computational power, is difficult and expensive on large networks like Bitcoin.

However, PoW is criticized for its high energy consumption. - Proof of Stake (PoS): In PoS, people “stake” (lock up) some of their digital coins as collateral. The system then randomly picks a “validator” from those who staked coins to add the next block.

Validators earn rewards for their honesty. PoS uses much less energy than PoW. Ethereum, for example, transitioned from PoW to PoS, reducing its energy consumption by 99.84%. PoS offers increased scalability, energy efficiency, decentralization, and security.

The evolution from Proof of Work to Proof of Stake represents a significant trend towards environmental sustainability and scalability within the blockchain space.

PoW’s high energy consumption led to the design of PoS as an alternative, offering greater energy efficiency.

While PoW offers security through computational cost, PoS shifts the security model to economic stake.

This can be more energy-efficient but introduces different considerations for decentralization, as a large concentration of staked assets could theoretically lead to centralization of control if a few entities hold a large portion of the staked coins.

Here is a comparison of these two consensus mechanisms:

| Feature | Proof of Work | Proof Of Stake |

|---|---|---|

| How it works | Miners solve puzzles with computing power | Validators stake coins; system picks one |

| Key resource | Computational Power (electricity) | Staked Coins (economic stake) |

| Main Benefit | High security for large networks | Energy efficiency, scalability |

| Main Drawback | High energy consumption | Potential for wealth centralization |

How to Get Started with Blockchain: Your First Steps

Ready to dive in? Follow these practical steps to begin your blockchain journey.

Step 1: Learn the Basics

Before you do anything else, learn the core ideas of blockchain. Understand digital ledgers, how blocks link, and how the network agrees on transactions.

This basic knowledge helps you later. Starting with a basic understanding of blockchain protocols and digital signatures forms the foundation for everything else you will learn. With this initial knowledge, you will be ready for deeper concepts like consensus mechanisms and smart contracts.

A solid understanding of these core principles is a prerequisite for understanding more advanced topics and for safe participation.

Without this foundation, later steps become confusing and risky.

Step 2: Choose a Blockchain Platform

Many blockchain platforms exist. Each one has different tools and features. Think about what you want to do. For example, Ethereum is popular for building decentralized applications (dApps).

Public blockchains like Bitcoin and Ethereum are open to everyone. Private blockchains, in contrast, restrict access. The choice of blockchain platform depends on your goals.

Different platforms support different functionalities and levels of openness, so select one that aligns with your intended use.

Step 3: Get a Crypto Wallet

You need a digital “wallet” to store your cryptocurrencies and other digital assets safely. Wallets come in different types, like software wallets (apps on your phone) or hardware wallets (physical devices).

- How to Set Up a Software Wallet: Download a wallet app, such as Coinbase Wallet. Create an account, often without needing personal information. Write down your recovery phrase (a 12 or 24-word phrase). This phrase is your private key. Keep it very safe, as you cannot access funds without it if you lose login credentials. Then, add crypto to your wallet by transferring tokens or linking to an exchange.

- How to Set Up a Hardware Wallet: Buy the device, often directly from companies or at stores. Download its compatible software. Connect the device to your computer, possibly via USB or wirelessly. Write down your recovery phrase and keep it in a safe place. Then, add crypto to your wallet.

- Custodial Wallets: These are wallets offered by exchanges. The exchange holds your private keys. This is easy, but remember a key principle: “Not Your Keys, Not Your Coins”. If the exchange experiences problems or closes down, you might lose access to your funds.

The choice of wallet type involves a trade-off between convenience, security, and control over private keys. Hardware wallets offer higher security through offline storage, while custodial wallets provide convenience at the cost of relinquishing control over your private keys. Understanding this trade-off is crucial for managing your digital assets securely.

Here is a comparison of common crypto wallet types:

| Wallet Type | Description | Key Benefit | Key Consideration |

|---|---|---|---|

| Software (Hot) | App on phone or computer | Easy access, convenient for transactions | Online, potentially more vulnerable to hacks |

| Hardware (Cold) | Physical device (USB stick) | High security (offline storage) | Less convenient, requires purchase |

| Custodial | Exchange holds your private keys | Very easy, managed by third party | You do not control private keys, exchange risk |

Step 4: Buy Your First Cryptocurrency

The easiest way to buy cryptocurrency is through a “cryptocurrency exchange”. This is an online marketplace.

- Choose an Exchange: Many exchanges are good for beginners and offer a wide range of cryptocurrencies.

- Pick Your Crypto: Most beginners start with Bitcoin or Ethereum. These are widely accepted and generally more stable than smaller, newer coins.

- Make Your Purchase: You can buy a whole coin or a small part of one. Link your bank account or use a debit/credit card. Fees can change based on how you pay.

Important Warnings:

- Volatility: Cryptocurrency prices can change fast and unpredictably. Only put in money you can afford to lose.

- Research: Always do your own research (DYOR) before buying. Understand the technology behind the coin. This helps you avoid scams.

- FOMO (Fear Of Missing Out): Do not make quick decisions based on seeing prices go up fast. This often leads to bad choices and losses, as timing the market is impossible.

Market volatility and scams are significant risks for beginners. This makes thorough research and responsible investment crucial. Many common beginner mistakes stem from a lack of foundational knowledge and emotional decision-making, emphasizing the importance of education and discipline.

Step 5: Explore Decentralized Applications (dApps) and NFTs

Blockchain is not just for money. You can also explore “decentralized applications” (dApps) and “Non-Fungible Tokens” (NFTs).

- dApps: These are software applications that run on a blockchain or a peer-to-peer network. They do not rely on a single central server. Smart contracts power their core logic, automating agreements and enforcing rules.

Users interact directly with dApps using their wallets, without intermediaries. Benefits include resistance to censorship, anonymity, zero downtime, and data integrity. Examples are Uniswap (a decentralized exchange for trading crypto) and Axie Infinity (a play-to-earn game). dApps represent a shift towards greater user control and reduced reliance on centralized entities, offering benefits like censorship resistance and data integrity. - NFTs: These are unique digital assets, like art or collectibles. You can find them on marketplaces such as OpenSea, Blur, or Rarible. You need a crypto wallet that supports NFTs, such as MetaMask or Coinbase Wallet.

Always research the project, its founding team, and its community before buying. Remember, NFTs can have high volatility and limited liquidity, meaning they might be hard to sell quickly. While NFTs offer unique digital ownership, their market is highly speculative and illiquid, requiring careful research and risk assessment.

Step 6: Join the Blockchain Community

Connect with other people interested in blockchain. Online communities play a big role in this space. You can find groups on platforms like Discord and Reddit. They offer timely information, discussions, and expert advice. Examples of active Discord servers include Jacob Crypto Bury, r/CryptoCurrency, and Axion Crypto-Community.

Active community participation fosters transparency, resilience, and responsiveness within decentralized projects, directly influencing their long-term growth and evolution.

For instance, Ethereum’s consensus upgrade was influenced by governance voting within its community. While communities are beneficial, beginners must remain vigilant against scams and misinformation. Always do your own research and be careful of scams, even within communities.

Common Challenges and How to Avoid Them

Starting with blockchain can have challenges. Knowing them helps you avoid problems.

- Not Doing Research (DYOR): Many beginners jump in without understanding the technology. Always research projects thoroughly to avoid scams.

- FOMO (Fear Of Missing Out): Do not make quick decisions based on price changes. This often leads to losses.

- Over-investing: Only invest money you can afford to lose. Cryptocurrency prices can change quickly.

- Security Lapses: Use strong passwords and two-factor authentication (2FA). Use secure wallets, like hardware wallets for long-term storage. Be careful of phishing scams.

- Not Your Keys, Not Your Coins: If an exchange holds your private keys, you do not truly own your crypto. Understand the difference between self-custody and custodial wallets.

- Transaction Errors: Double-check wallet addresses and the type of cryptocurrency before sending. Transactions are final and irreversible.

- Technical Hurdles (for developers): Building blockchain applications can involve complex data processing on the front-end, as decentralized apps often lack backend servers. You may also find poorly written code in fast-moving projects, requiring refactoring and maintenance.

- Interoperability: Connecting different blockchains remains a challenge for the industry.

- User Experience: Some blockchain applications can be hard for new users to understand.

Many common beginner mistakes stem from a lack of foundational knowledge and emotional decision-making. This emphasizes the importance of education and discipline. The decentralized nature of blockchain, while a benefit, also shifts responsibility for security and data management more heavily onto the user. This requires heightened awareness and adherence to best practices.

Resources for Further Learning

Continue your learning with these trusted sources.

Reputable Blockchain Learning Resources

| Resource Name | Type | Focus Area | URL |

|---|---|---|---|

| Coinbase Learn | Educational Platform | Beginner basics, digital currencies | https://www.coinbase.com/learn |

| Binance Academy | Educational Platform | Crypto terms, concepts, blockchain ecosystem | https://academy.binance.com/ |

| CoinDesk | Media Platform | News, podcasts, research, beginner guides | https://www.coindesk.com/ |

| Cointelegraph | Media Platform | Blockchain, crypto, FinTech news | https://cointelegraph.com/ |

| Investopedia | Media Platform | Simplifies financial information | https://www.investopedia.com/ |

| Decrypt | Media Platform | Educational articles, news | https://decrypt.co/ |

| TheCryptoBasic.com | Media Platform | News, basics, project reviews | https://thecryptobasic.com/ |

| Blockchain Specialization (U. Buffalo) | Academic Course | Basics, smart contracts, dApps | https://tech.seas.harvard.edu/free-blockchain |

| Blockchain: Foundations and Use Cases (ConsenSys) | Academic Course | Comprehensive introduction | https://www.coursera.org/learn/blockchain-foundations-use-cases |

| Bitcoin and Cryptocurrency Technologies (Princeton) | Academic Course | Cryptocurrency, Bitcoin, blockchain concepts | https://www.coursera.org/learn/bitcoinandcryptocurrency |

| Blockchain Research Institute (BRI) | Organization | Research, education, advisory services | https://www.blockchainresearchinstitute.org/ |

A wide array of educational resources exists for learning about blockchain, from general news to academic courses. The diversity of resources, including university courses, established financial news sites, and “earn-to-learn” platforms, indicates a growing maturity and legitimization of blockchain education.

These resources cater to various learning styles and technical depths. For beginners, prioritizing resources that simplify complex concepts and offer practical application, such as “101 explainers” or “learn and earn” models, can significantly improve their learning curve and engagement.

Frequently Asked Questions (FAQs)

Here are answers to common questions about blockchain.

- What is a Blockchain? A blockchain is a digital ledger maintained by many interconnected computers, called nodes. It stores transaction information in blocks, and cryptography links these blocks together.

- Is Blockchain the same as Bitcoin? No. Bitcoin is a cryptocurrency that uses blockchain technology. Blockchain is the underlying system that Bitcoin runs on.

- What keeps Blockchain secure? Blockchain uses cryptography to link blocks, has many copies across the network, and uses consensus mechanisms to agree on transactions. These features make it very secure.

- What are Smart Contracts? Smart contracts are agreements stored on the blockchain. They automatically execute when certain conditions are met, without a middleman.

- What are dApps? dApps, or decentralized applications, are software applications that run on a blockchain. They use smart contracts for their functions.

- How do I get a crypto wallet? First, choose a wallet type (software, hardware, or custodial). Then, download or buy it, set up security features like a recovery phrase, and finally, add cryptocurrency.

- Can I lose my crypto? Yes. You can lose crypto through scams, if you lose your private keys, or if an exchange you use fails (if you do not hold your own keys).

- What is Proof of Work (PoW) and Proof of Stake (PoS)? These are consensus mechanisms. They help blockchain networks agree on new transactions. PoW uses computer power to solve puzzles, while PoS uses staked (locked) coins.

- Is cryptocurrency a good investment? It depends on your personal goals and risk tolerance. Cryptocurrencies are volatile, so always do your own research and only invest what you can afford to lose.

This FAQ section directly addresses common beginner queries. It also reinforces core concepts and common beginner concerns, acting as a quick reference and further solidifying understanding from the main content.

Conclusion: Start Your Blockchain Journey

Blockchain offers new ways to handle data and value. This guide helped you understand its core ideas, uses, and how to begin. Take these first steps: learn, get a wallet, and buy your first crypto. Share this guide with friends who want to learn. Leave a comment below with your questions or experiences.

IT Security / Cyber Security Experts.

Technology Enthusiasm.

Love to read, test and write about IT, Cyber Security and Technology.

The Geek coming from the things I love and how I look.